Awareness # 4- Lack of Performance Analytics

Traders have the account history to monitor what they have done on their trades but they lack the discipline or knowledge on how to use this information.

We like to suggest that you take blocks of 20 trades to analyze. Once you have completed the first block keep track of how many were profitable and how many were losers. Keep track of the profit level. Keep track of what you did right and what you did wrong. Keep track of how you felt on these trades. Keep track of why you took each trade and why you closed each trade. Now take a second block of 20 trades and keep the same records you did on the first block of 20 trades. Watch for any improvements or digressions in your trading.

This is the beginning of your trade journal and part of your trading skill assessment. Look at the following record that came form MetaTrader 4 trading platform.

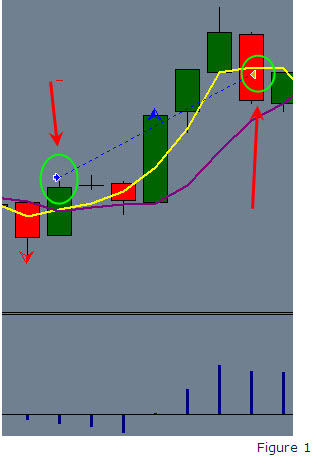

Refer to figure 1. The two arrows in the circles are the points where this trade was opened and closed. You can get this information by gong to the account history, clicking on the closed trade, dragging it to the chart area and dropping it. This will give you the markings of the trade. You then can print this screen off, make any notes, and put it in your trade journal.

This makes a demo account productive if a trader will use it. They will not be a wait and see trader.