This can be easy once you know what to look for. Your search of how to determine what a trending market is, can take a lot of time and experience but with the right instructions you can find it very quickly. A choppy, or flat market is hard to trade and can lead to overtrading, while a trending market can be easier to trade and can be very profitable. Trading with the trend is not as much work you do not have to watch the computer as much and it is more likely that you will make more money. Another advantage of trading the trend is that placing your stops becomes much easier so you don’t get stopped out as much. When a trade was missed there is no need to worry because there will be a retracement so you can get in on part of the trend.

Here are some examples of how to find a trend and make a trade in the direction of the trend.

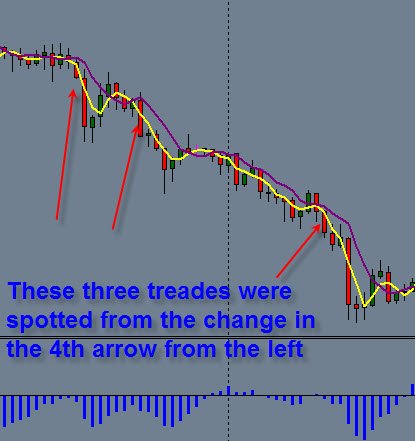

On this 4-hour chart you will see signals that indicate that you should look at a smaller time frame for an entry point. The two types of signals to look for are when the candles close lower or higher than the previous candle, and when the candles close below or above the purple line.

When you see one of these signals then look at a smaller time frame for entry signals.

Both of the entry signals on this 30-minute chart come from the first two arrows on the left of the 4-hour chart.

The first move was for 20 pips the second was for 50 pips and the third was for 70 pips for a total of 140 pips. If you had entered the first trade and stayed in the complete trend you would have made 250 pips.

We were using moving averages here along with an oscillator. We like to have two confirm signals to enter but just the moving averages are good enough to get a heads up, to go look at an entry point.