Trading the trend can be profitable, that is if you can identify the trend in a timely manner and then manage the risk along the way. The good thing is that trading the trend can apply to any currency pair or time frame. Here is some more good information the trend can help you systematically determine when to enter a position, how much to trade, and when to exit. A trader might think of trading the trend as taking the path of least resistance. If the currency is moving in a good trend then the further it moves, all I have to do is hop onboard, determine my risk level, and enjoy the ride.

Lets look at some basics. Identifying a trend is purely technical. If you have analyzed charts, you know that prices move in waves. By watching the way the waves move, you can see the direction of the trend.

(figure B) See on this 4-hour chart that the market moves then rest then moves more. Each of the rests and moves have different sizes and strengths.

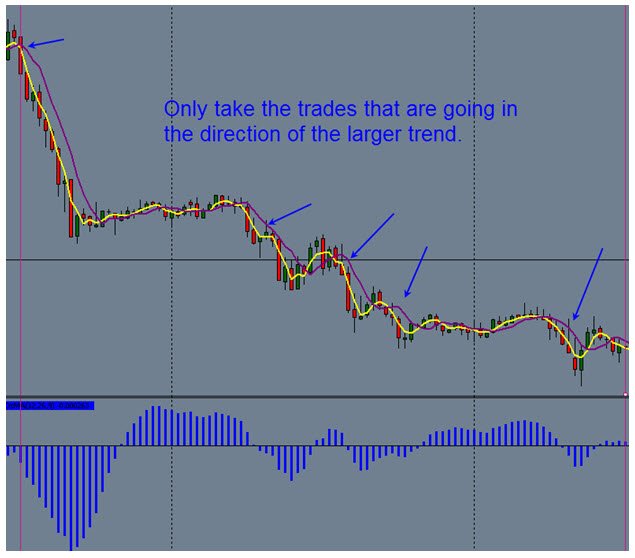

Now look at the same move as above but it is on a 30-minute time frame. There are 5 different entry signals you can see them by the way the prices flow in waves.

The picture shows this currency is moving lower. This is evident by looking at the highs and lows, or peaks and troughs, made by the currency price. An uptrend has successively higher highs and higher lows, while a downtrend has successively lower highs and lower lows.

The angle of the trend is import to notice. Not all currencies move in the same angle, distance, or speed. Some move fast and others move slowly. When selecting a currency pair to trade notice that a currency that moves up fast will move down fast as well. Also trends with steeper angles are the hardest to sustain over time.

The key to large gains is to identify the trend as early as possible. Identifying a trend is a visual process most are discovered in hindsight. However, if you keep close tabs on the market, watch the indicators and alerts then these moves should be easy to identify.

Entry points are the easiest part of trading a trend. As long as you are focused on risk management and have predetermined position size, the entry point should not be the main focus of your system. Yet a good entry may produce some good gains more quickly and make it easier to manage your position out of the gate.

Where to exit a trade is one of the most important parts of profitable trading. When you close a trade, your efforts are finalized with a gain or a loss. This brings us to a good entry can lead to easier exits, but a predetermined exit strategy is a critical part of a successful trading effort.

Exit points should be determined using the same indicators that were used when the trade was entered. Establish the exit upfront and be disciplined in your follow-through.

Risk management and the size of the trade are the most critical elements of a successful trend-trading system. After conducting your analysis, decide how much you want to risk on a trade. Remember, the most critical ingredients of a successful trading plan are managing risk and cutting losses quickly.

Once the trend has proven itself then you might want to consider adding on to the trade. One of the easiest ways to do this is to go to a smaller time frame and take all the signals that are going in the direction of the trend. See the examples above. You may watch for a pull back on the smaller time frame, then enter when the indicators give you a signal in the direction of the trend. You should use the same indicators you used to enter the trade in the first place, so as to keep the advantage in your favor and your trading positions at a low-risk level.

In summary, trend trading is a systematic approach to the market that aims to take advantage of only those currency pairs that are moving in a trending direction. Good fundamental information can help tell you what to trade but through technical analysis you can determine when to enter a trade.