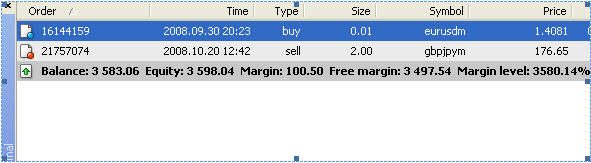

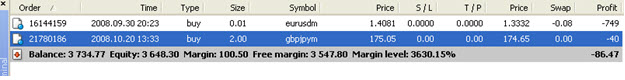

In the following illustrations you will see the equity level change and the Margin Level % change. There are several views of the change in a positive direction and one view with a negative direction. The Margin Level % is calculated by dividing the equity by the margin. In the illustration below we take the equity of 3598 divided by the used margin of 100.5. 3598/100.5=35.80 then you need to move the decimal over to the right two positions to get the 3580%.  In the next few illustrations take note of the Equity and Margin Level % changing as the price changes. Also take notice we have two trades on one is 2 lots and the other is .01 lot. The .01 lot trade is extremely negative by 655 pips, it is so small that it does not affect the margin much. It is negative by $6.55 which is not going to change the margin Level % much. This account is set at 1:200 leverage so the .01 is only using .50 of the available margin and each of the lots on the 2.0 trade is using $50 for a total of $100 being used.

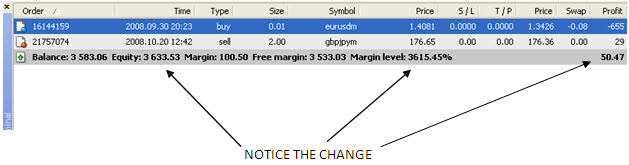

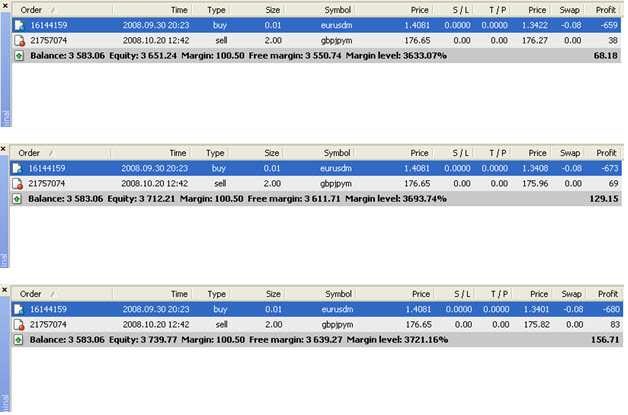

In the next few illustrations take note of the Equity and Margin Level % changing as the price changes. Also take notice we have two trades on one is 2 lots and the other is .01 lot. The .01 lot trade is extremely negative by 655 pips, it is so small that it does not affect the margin much. It is negative by $6.55 which is not going to change the margin Level % much. This account is set at 1:200 leverage so the .01 is only using .50 of the available margin and each of the lots on the 2.0 trade is using $50 for a total of $100 being used.  Practice dividing the Equity by the Margin to get the Margin Level % number. 3651/100.5 to get the 36.33 then, move the decimal over two points to match the 3633 in this example.

Practice dividing the Equity by the Margin to get the Margin Level % number. 3651/100.5 to get the 36.33 then, move the decimal over two points to match the 3633 in this example.  In the following example there is a negative in the profit column and the equity is less than the balance. A VERY IMPORTANT THING TO REMBER IS THAT THE EQUITY IS THE MONEY YOU REALY HAVE NOT THE BALANCE. When a hedge is placed you will generaly have a negative equity. The balance will remain the same as it was when the order was placed. If you were to close all open trades then you would see that the equity is what is left and it is now equal to the balance.

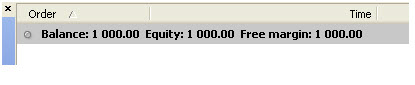

In the following example there is a negative in the profit column and the equity is less than the balance. A VERY IMPORTANT THING TO REMBER IS THAT THE EQUITY IS THE MONEY YOU REALY HAVE NOT THE BALANCE. When a hedge is placed you will generaly have a negative equity. The balance will remain the same as it was when the order was placed. If you were to close all open trades then you would see that the equity is what is left and it is now equal to the balance.  Margin Call example This account was opened with $1000. You can see that the Balance Equity and Free margin are all the same.

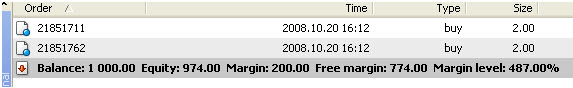

Margin Call example This account was opened with $1000. You can see that the Balance Equity and Free margin are all the same.  We have entered into two trades notice the margin level % it is now 487%

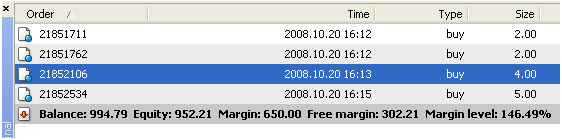

We have entered into two trades notice the margin level % it is now 487%  There are two additional trades added. Notice the margin level 5 is now 146%

There are two additional trades added. Notice the margin level 5 is now 146%  Notice the free margin is now -182% and the margin level % is 80%. This accouint will receive a margin call when this percentage goes below 50%. Then the platform will close the trade that is most detramental to you or the largest loss. If the percentage go above 50% the platform will continue to run the open positions. If the Margin level % drop below 50% again then the next trade will be closed.

Notice the free margin is now -182% and the margin level % is 80%. This accouint will receive a margin call when this percentage goes below 50%. Then the platform will close the trade that is most detramental to you or the largest loss. If the percentage go above 50% the platform will continue to run the open positions. If the Margin level % drop below 50% again then the next trade will be closed.  Now notice the numbers below. When it is getting close to a margin call the platform will turn pink so you can visualy notice that there is a problem.

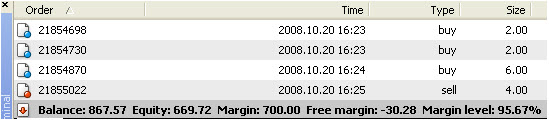

Now notice the numbers below. When it is getting close to a margin call the platform will turn pink so you can visualy notice that there is a problem.  Below you will see that the 5 lot trade was closed and the Margin Level % is back up to 95%. A margin call is not an exit strategy. This article is to help you learn how to manage your trades and develop good money management practices.

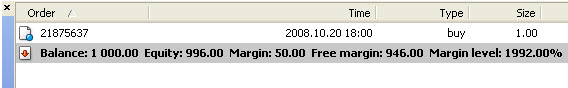

Below you will see that the 5 lot trade was closed and the Margin Level % is back up to 95%. A margin call is not an exit strategy. This article is to help you learn how to manage your trades and develop good money management practices.  It is a good trading prdactice to never over trade your account. If you were to trade only 5% of a $1000 account it would look like the following. In the illustration we have only traded 5% of the $1000 account which is one lot. Notice the Margin level % is still 1992% and we have only used $50 of our available margin. By using a reasonable amount of margin on a trade you will be able to close this trade if it goes against and not take your whole account. If you over trade your accouint like the illisration above then you are setting yourself up for losses.

It is a good trading prdactice to never over trade your account. If you were to trade only 5% of a $1000 account it would look like the following. In the illustration we have only traded 5% of the $1000 account which is one lot. Notice the Margin level % is still 1992% and we have only used $50 of our available margin. By using a reasonable amount of margin on a trade you will be able to close this trade if it goes against and not take your whole account. If you over trade your accouint like the illisration above then you are setting yourself up for losses.